[ad_1]

Finding the right savings account can get you an extra $200 for free this year.

Depending on your balance, it could make you a lot more money.

Let’s say you have $10,000 to put into an online savings account.

How much would that turn into at a big bank savings account? Most big banks have an APY (annual percentage yield) of 0.15% or less. After a year, your account would be worth $10,015. Not much of a gain there.

I love getting money for nothing, but even I have a hard time getting excited over an extra $15.

Now let’s say you take that same $10,000 and put it into an online high-yield savings account with an APY of 2.25%.

After a year, you’ll have $10,225.

That’s $225 for doing absolutely nothing. Everyone needs some extra cash on hand for an emergency fund anyway. Why not get as much as you can while it sits there? All it takes is opening the right savings account.

The best online savings accounts

These accounts have the highest APYs right now. While I don’t personally choose accounts solely on the APY, start with these if you want the highest APY possible:

We’re going to do a deep dive into what to look for, which accounts are best, how to get the highest APY, and tricks for optimizing your savings accounts.

If you want to skip all that and open an account right now, all of these savings accounts are among the best:

- Discover Online Savings Account

- Ally savings account

- Marcus by Goldman Sachs

- American Express savings account

- Barclays savings account

- Synchrony savings account

You’ll be happy with any of them. My personal favorite is Ally.

What matters when picking an online savings account

Here’s how we evaluate the best savings accounts.

User experience

Good online and mobile apps make a huge difference these days.

While I do appreciate a great user experience, I do have to say that it doesn’t matter as much with a savings account.

It needs to be good enough but not great.

Why?

Because we rarely log into savings accounts. Savings accounts usually have limits of being able to withdraw from them up to 6 times per month. By definition, they’re not meant to be used regularly.

With one of my accounts — my emergency fund that I never touch — I log into it maybe once a year during tax season to grab the annual tax form. Otherwise, I never log in at all.

So the user experience should be good enough that it’s not infuriating, but it doesn’t need to be cutting edge. That adds a lot more value for checking accounts, which we do access all the time.

Fees

For online savings accounts, it’s absolutely essential that you get an account without any maintenance fees. Monthly maintenance fees used to be common. Thankfully, just about all the online savings accounts have done away with them.

On any good savings account, you’ll rarely run into fees during normal usage. But even on the best accounts, it is possible to trigger fees for certain events:

- Returned deposit items

- Overdraft items paid or returns

- Excessive transaction fee (like going over 6 withdrawals per month)

- Expedited delivery

- Outgoing domestic wires

- Account research fees

We’ve made sure not to include any banks in our list that have maintenance fees. But you should be aware of some of these other fee items that do exist on every account.

Convenience

What we consider to be “convenient” with savings accounts falls into two buckets depending on where you are in your own personal finance journey.

When you’re building savings for the first time, it’s essential to get a savings account with no minimum balance. A $5 required balance or something like that is fine, you just don’t want to have to worry about a higher one.

Don’t put up with any account that requires a sizable minimum balance. There are so many options that don’t have any balance requirements at all. This is the last thing you should be worried about in the early days, especially if an emergency comes up and you need to withdraw cash.

Later on, what you consider to be convenient typically changes.

Once you’ve built enough of a cash buffer for yourself, you’ll care a lot less about minimum balances. Instead, your accounts, cards, and banks have all gotten complicated enough that simplicity matters a lot more than it used to. At this stage, some folks will opt for a lower APY in order to consolidate their accounts and make everything more manageable.

Is this the optimum strategy to get every ounce of growth from your cash? No, it isn’t. But the extra piece of mind can be well worth the cost. If this sounds appealing to you, check to see if the savings account at your main bank has a good enough APY without any maintenance fees. If it does, it could be your best option.

FDIC insured

Don’t ever consider an online savings account that’s not FDIC insured. This means that the account is guaranteed by the federal government up to $250,000 per depositor. If something horrible should happen to the bank, the federal government guarantees you’ll still get access to your balance, up to $250,000. This is per depositor, so the $250,000 includes the combined balance of all your savings accounts at the same bank.

Just about every savings account is FDIC insured. It’s been a standard practice for a long time. But keep a close eye on this any time you’re considering an innovative or unique approach to storing your cash.

For example, some folks will store their cash in a money market account, which operates a lot like a savings account. Money market accounts are usually FDIC insured. But money market funds, which you place cash into from a brokerage account, are not FDIC insured. A subtle yet critical difference during tenuous times.

Another example: Robinhood attempted to roll out a checking account that promised a 3% APY. That’s a checking account paying higher interest than any savings account that was available at the time, by almost 1%. Sounds amazing right?

It came with a number of catches, one of which was that it wasn’t FDIC insured. Without the FDIC insurance, we don’t consider the higher APY worth the risk.

Our stance is that every dollar of our savings should be covered by the FDIC, even if the balance is high enough that we have to split it up between multiple savings accounts.

All of the savings accounts that we review below are FDIC insured. Just keep an eye out for this if you’re exploring an atypical approach to storing your cash.

APY rates

APY rates — the annual percentage yield — are the main difference between savings accounts. The higher your APY rate, the more money that you get automatically every month.

APY rates across saving accounts generally fall into 3 tiers.

Big bank savings account APYs

For the vast majority of big bank savings accounts, the APY is terrible. Big banks assume that you want a savings account along with your checking account, so they don’t do anything to entice you for the savings account itself. Even when plenty of online high-yield savings accounts are offering an APY of 2%, big banks might only offer a 0.15% APY. On a savings balance of $10,000, that’s a difference between making $200 a year versus $20 a year.

This doesn’t apply to ALL big banks, but most of them do fall into this category. So keep an eye out for these. Unless you really want to maximize convenience by consolidating accounts and taking a lower APY, it’s worth finding a savings account with a higher APY.

High yield savings account APYs

High yield savings accounts have become extremely popular. These banks don’t have branches, they’re 100% online. Since save a lot from not having physical locations, they pass the savings onto you with a higher APY.

Ally and American Express are two of the most popular banks in this category.

The APY also stays updated over time. Back during the financial crisis, the Federal Reserve dropped interest rates to 0% and most high yield savings accounts had APYs of 0.5-0.7%. As the Federal Reserve increased interest rates, these same accounts also increased their APY. Whenever interest rates increase, you’ll get those increases automatically from these accounts. No need to constantly switch between accounts and chase the best rate.

Cutting edge APYs

At any given moment, there are a few banks that are pushing the APYs higher than anyone else. They’re doing this as a promotional strategy to attract more customers. Some of these banks keep pace with changing interest rates, some of them don’t.

While we don’t consider it worth the effort to chase an extra 0.1% on our APY, these banks are an option if you’re looking to maximize the APY on your savings.

Online savings account reviews

Here’s the lowdown on the most popular online savings accounts.

Axos savings account

- FDIC insured: Yes

- Minimum balance: None

- Maintenance fees: None

- APY: 1.30%

The APY is much lower than other high-yield savings accounts — it’s average at best. There’s no reason to open an Axos account unless you’ve already maxed the FDIC limits on every other high-yield savings account and have to get a lower APY to horde all your cash.

I recommend picking one of the other accounts from this list.

Discover online savings account

- FDIC insured: Yes

- Minimum balance: None

- Maintenance fees: None

- APY: 1.60%

Discover’s APY is pretty strong. Not quite the top, but it’s really close.

And if you happen to have a Discover card or checking account, keeping your accounts in one place makes everything a lot simpler.

If you have another Discover account, definitely get a Discover savings account.

HSBC

HSBC has a few different savings accounts.

- FDIC insured: Yes

- Minimum balance: $100,000 across your deposit accounts and investment balances. If you go below this balance, there’s a $50 monthly fee.

- Maintenance fees: None

- APY: 0.15%

The HSBC Premier accounts are for clients who have large deposits at HSBC. Unfortunately, the APY is awful. An APY that low with a minimum balance of $100,000 is kind of insulting.

This is a good example of a classic big bank savings account. A bunch of constraints with a terrible APY. Skip these accounts entirely.

- FDIC insured: Yes

- Minimum balance: $1

- Maintenance fees: None

- APY: 1.85%

HSBC does have a high-yield savings account with a competitive APY. Normally, I’d recommend this account as a main contender.

But HSBC is just a terrible bank. Every interaction with them is more difficult than it has to be. The only reason I’d ever consider opening an HSBC account if I needed a giant, international bank for some reason.

Even though this account looks great on paper, you’ll regret it if your experience is anything like ours.

Ally savings account

- FDIC insured: Yes

- Minimum balance: None

- Maintenance fees: None

- APY: 1.6%

We’re huge fans of Ally. They’ve become one of the leading high-yield savings accounts.

Yes, Ally doesn’t technically have the highest APY, but it’s darn close. And they update their APY often. So if interest rates continue to rise, you’ll get a higher APY without having to do anything.

Their account UI is pretty slick too, and it’s always improving.

I have an Ally account myself.

Feel free to stop reading here and open an Ally account right now. You won’t regret it.

Capital One 360 Savings

- FDIC insured: Yes

- Minimum balance: None

- Maintenance fees: None

- APY: 1.7%

Capital One used to have an APY that lagged the rest of the market, making it a sub-standard choice. You’d have to use another bank or their Capital One 360 Money Market account to get a competitive APY.

Now they have an APY that’s just as good as most banks. It’s one of the top contenders.

Especially if you have Capital One credit cards, it’s really nice to keep everything at one bank.

Marcus by Goldman Sachs

- FDIC insured: Yes

- Minimum balance: None, but there is a deposit limit of $1,000,000 for all your savings account and CDs

- Maintenance fees: None

- APY: 1.7%

Goldman Sachs jumped into the high-yield savings account space with one of the highest APYs.

They do limit deposits to a total of $1,000,000, but that’s not a major concern. You’ll want to split up your cash balances across multiple banks to get it all FDIC insured anyway.

If you’re looking for your first high-yield savings account, this is a fantastic option.

American Express savings account

- FDIC insured: Yes

- Minimum balance: None

- Maintenance fees: None

- APY: 1.7%

American Express was one of the first to introduce a high-yield savings account, and it’s been around for awhile now.

These days, the APY is slightly lower than some of the competitors. While American Express does update their yields frequently, they’re always 0.10-0.20% off the highest rates. While it’s still a great option, I’d choose one of the other accounts for this reason alone.

One other caveat: the American Express savings account isn’t integrated into the same login account as the American Express credit cards. Even if you have both, it feels like having two different banks. There’s no extra simplicity from trying to consolidate.

Barclays savings account

- FDIC insured: Yes

- Minimum balance: None

- Maintenance fees: None

- APY: 1.7%

Another great option. Great APY, no maintenance fees or minimum balances — you can’t go wrong with a Barclays online savings account.

Synchrony savings account

- FDIC insured: Yes

- Minimum balance: None

- Maintenance fees: None

- APY: 1.7%

Synchrony is also a great option. The APY is one of the highest and has no minimums or maintenance fees.

The 4-step process to picking the best online savings account

- Check the banks that you currently have accounts with and see if they have a competitive savings account. If the APY is comparable to the accounts we listed above, stick with your current bank.

- Otherwise, pick an account from this list:

- Try to pick an account from a bank that you foresee doing other business with. For example, Ally has car loans and Discover has their credit cards.

- If you’re still not sure, go with Ally.

What about sub-savings accounts?

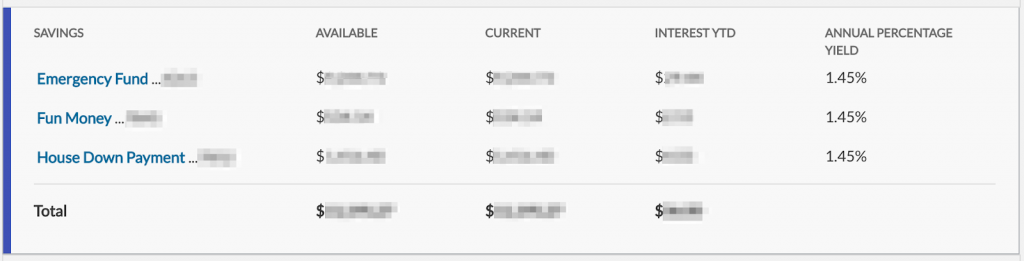

One of our favorite savings account tricks is to open “sub-accounts.” This allows us to easily budget for bigger purchases by saving a little bit each month. We can also track everything by separating all the accounts.

For example, I have these categories in my own savings account:

- Emergency fund

- House downpayment

- Mini-retirement

- Christmas gifts

- Annual vacation

Each month, money goes into each of these separate accounts with the automatic transfers that I set up. And I can easily see how much I’ve saved towards my goals.

Ramit’s savings accounts used to look like this back before ING Direct was bought by Capital One:

Here’s a more current example in Ally:

Here’s a more current example in Ally:

Some savings accounts will call these “sub-accounts,” and everything will be part of the same savings account. This is a rare feature to find though.

Some savings accounts will call these “sub-accounts,” and everything will be part of the same savings account. This is a rare feature to find though.

For everyone else, simply open up multiple savings account under the same bank login. You can easily have 5-10 savings accounts at the same bank. Then treat each account for whatever saving category that you like.

This means you can get “sub-accounts” at any bank, even if they don’t have a “sub-account” feature.

Don’t chase yields

Look, there’s always a bank that has a slightly higher APY. Banks use it as a promotion strategy to get more accounts, so it’s always changing.

Regularly researching new APY rates, looking for that extra 0.05% APY, opening accounts, and transferring money all over the place wastes more time than it’s worth.

Don’t be a rate chaser.

Remember IWT’s philosophy of big wins. Focus on the major wins that really move the needle and forget about the small stuff. Chasing higher APYs on savings accounts definitely falls into the “small stuff” category.

Pick a savings account that has a competitive APY from a bank that you trust for the long term. Then stick to that decision and work on improving other areas of your life.

Money market accounts vs savings accounts

The difference between money market accounts and savings accounts can be pretty confusing.

That’s because there’s no practical difference.

Here are the similarities:

- The APY tends to be the same between both types of accounts.

- You can withdraw up to 6 times per month.

- Some have ATM cards, some don’t.

- Some have minimums, some don’t.

- Both are FDIC insured.

Basically they’re the same account. If your bank happens to offer a money market account with no maintenance fees, no minimum, and a competitive APY, feel free to use it.

Now for the confusing part: money market funds are completely different. They’re part of brokerage accounts and allow you to place cash while you wait to invest it. Since money market funds are not FDIC insured, so it’s not a good habit to store lots of cash in them.

When to get savings accounts from multiple banks

If you ask high net worth folks which savings accounts they have, sometimes they’ll list off half a dozen different banks.

At first, this makes no sense. Why all the extra complexity and different accounts?

There’s one reason: FDIC insurance limits.

Most people are limited to $250,000 worth of insurance at any given bank. Joint accounts and accounts across different categories (like retirement accounts) can increase this limit, but that only goes so far. If you have a substantial amount of cash, the only way to keep it insured is to open up savings accounts across several banks.

That’s why folks will start opening up savings accounts across multiple banks.

If you have multiple savings accounts to manage, Max will automatically move balances around your accounts to optimize for the highest APY while keeping all your cash insured. They do charge a 0.08% annual fee for the service.

As for which accounts to open, we recommend starting with these:

- Ally savings accounts

- Barclays savings account

- American Express savings account

- Marcus by Goldman Sachs

Any combination of accounts that have strong APYs will work.

<!–

function getQueryStringVariable(variable) {

var query = window.location.search.substring(1);

var vars = query.split(‘&’);

for (var i=0;i

The best online savings accounts of 2020 is a post from: I Will Teach You To Be Rich.

[ad_2]